The Federal Competition and Consumer Protection Commission (FCCPC) recently introduced the Digital, Electronic, Online, or Non-Traditional Consumer Lending Regulations on July 24, 2025, which is set to take effect from October 22, 2025.

With more than 500 digital lenders operating in the Nigerian market, some lending practices often go unchecked. To address this, the new regulation is a conscious effort to keep a close eye on lenders and prevent unethical consumer lending behaviours. Now, digital lenders in Nigeria are liable to be fined between ₦50 million and ₦100 million, or 1% of their annual turnover, if they violate the new FCCPC regulations.

If you’re unsure what these regulations would mean for your lending business and how to avoid penalties, we’ll break it down and explain how you can protect your customers while staying compliant.

Who does this regulation impact?

More than just digital lenders, this regulation also affects alternative lending operators like cooperative societies, telco providers offering airtime and data loans, and e-commerce businesses with BNPL payment options.

Service providers are included, too. Payment processors that collect repayments for lenders, to credit bureaus providing access to users’ credit information, or loan recovery agents are expected to be registered with the FCCPC and also ensure that the lenders they serve are compliant. Retailers, agri-tech businesses, or vendors who partner with lenders are affected by the regulation.

However, this directive doesn’t just cover lenders operating in Nigeria, but also lenders anywhere in the world offering loans to Nigerians.

What does the new FCCPC consumer lending regulation mean for you?

As a lender

The new regulation is designed to protect consumers and financially vulnerable individuals from unfair and unethical lending and collection practices.

For example, if a lender in Nigeria uses predatory methods to assess borrowers, such as requesting access to their contact lists and photos, or threatening debtors for repayment. In that case, the FCCPC will now penalise lenders for these kinds of unethical activities.

Any lender not compliant with the new regulation could face stringent penalties, including fines of up to ₦50 million for individuals and ₦100 million for companies, or 1% of their previous year's turnover. Businesses could also face sanctions, like delisting of their registration, revocation of approval, or shutdown of their operations. Company directors are not left out either; they could be banned from holding directorial roles for up to five years.

To further protect consumers, lenders must ensure that every consumer-facing advertisement and messaging isn’t misleading or threatening. They have to be transparent about any fees they charge and only approve loans for borrowers who can afford to repay them. The FCCPC will also monitor interest rates to ensure they are fair and not exploitative of borrowers.

In addition, lenders must be prepared to submit biannual reports, file their annual returns, update their compliance documents, and share consumer records within 48 hours of request.

As a non-lending provider in the credit value chain

For non-lending providers, the same rules apply. If your processes are not compliant with the regulation, you are liable to pay fines of up to 50 million for individuals and ₦100 million for companies, or 1% of your previous year's turnover. In addition, your company directors can be disqualified from holding their roles for up to five years.

Other penalties include the delisting of your registrations or suspension of operations. Approvals can also be withdrawn if a business submits false or misleading information, breaches any of the FCCPC regulations, or engages in practices that are harmful to consumers.

Lastly, you are expected to submit biannual reports, file your annual returns, routinely update your compliance processes, and share consumer records within 48 hours of request.

How to get registered and approved?

Lenders, lenders’ collection agents, credit bureaus, cooperative societies, and any service that provides credit facilities to consumers must register with the FCCPC and obtain approval to continue offering their services.

Getting your business registered with the FCCPC requires filling out the Digital, Electronic, Online, or Non-Traditional Consumer Lending (DEON CL) form, performing background checks, and submitting certain documents, like:

Corporate Affairs Commission (CAC) records

Full disclosure of company directors and shareholders

Policies for privacy, data protection, and customer service

Tax compliance documents

Compliance Audit Report

Data Protection Impact Assessment (DPIA)

You’re also expected to pay registration and approval fees. Application fees cost ₦100,000, with approval fees at ₦1 million, covering two loan apps. Adding extra apps costs ₦500,000 each, with a maximum limit of five apps. However, approvals expire after three years and must be renewed every 36 months, subject to a fee of ₦500,000.

Microfinance banks, on the other hand, are exempt from registration but must apply for a waiver from the FCCPC.

How to keep your lending business compliant with the FCCPC regulation

Lenders who want to get ahead and proactively remain compliant should employ strict processes and use equally compliant solutions that can power all or many parts of their lending processes.

Building compliant processes:

Lending is a culmination of many micro processes happening underneath. From our experience powering some of the most innovative lenders in the market, we’ve learnt that the best way to be ethical is to build this process from the ground up. When collections fail, borrowers become unresponsive, and loans go bad, lenders can often retrace their steps to earlier parts of the process where some signs of risk may have appeared and been ignored.

This is why every lender needs a set of rules and processes that work to prevent bad loans/poor collections from the beginning of the borrower’s application journey.

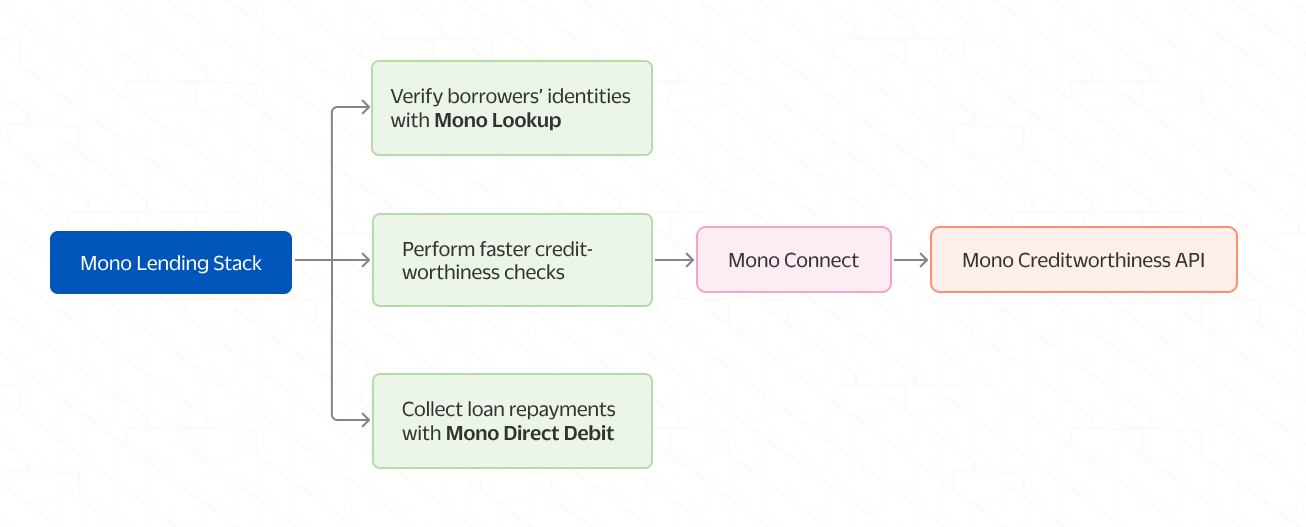

Today, compliant lenders of various sizes embed Mono products across various points in their lending strategy, from assessment to collections. Here are some ways that Mono’s Open Banking APIs are enabling lenders’ operations, end-to-end.

Verifying borrowers’ identities: At the start of the loan application process, it’s crucial to verify borrowers’ identities to prevent lending to people using stolen or false details. The Mono Lookup and Mono Prove [beta] products offer multiple KYC/KYB verification endpoints, allowing you to easily confirm account ownership and validate personal data submitted by potential borrowers in minutes. This ensures that assess and lend to only verified customers, lowering fraud risks.

Performing creditworthiness assessments: The new FCCPC regulation prohibits lenders from requesting access to borrowers’ contacts, photos, call logs, or any sensitive personal data to qualify them for loans. Now, creditworthiness assessments must be done right to ensure loans are only given to borrowers who are capable of repaying them. To prevent reliance on self-reported, intrusive, slow, or traditional methods of credit scoring, lenders can use Mono Connect or the no-code Mono Statement Pages to securely access customers’ historical and real-time financial data and bank statements for loan eligibility checks. The Mono Creditworthiness API also allows you to evaluate users’ credit history, cash flow trends, and debt-to-income ratio to determine if they can comfortably afford to repay the loan.

Recover loan repayments: With the new consumer lending regulations, lenders must avoid predatory loan recovery methods, especially if they want to avoid penalties. Mono Direct Debit offers a faster and more secure way to recover loans; by allowing your customers to authorize a direct debit mandate on their account, you can automatically collect repayments on agreed dates securely and with their full permission.

Overall, the new FCCPC regulation is driving a major shift in how consumer lending is done in Nigeria. Lenders now face stricter oversight on their operations with higher penalties for non-compliance. Borrowers are also better protected, treated more fairly, and can access credit without invasion or compromise of their privacy.

Lenders who want to adapt quickly, stay compliant, and win more customers can use Mono’s credit-focused products to access borrowers’ financial information, verify their identities, and collect loan repayments. This ensures that their lending practices are secure, data-informed, and transparent, building trust with customers.

If you want to unlock safer and more responsible lending with Mono, get started at mono.co/signup and check our technical documentation, or fill out this form to speak directly with our sales team.